Know Your HSN Code

| HS Code: | |

|---|---|

| Item Description | |

| Basic Customs Duty(BCD) | |

| Customs AIDC | |

| Custom Health CESS(CHCESS) | |

| Social Welfare Surcharge(SWC) | |

| IGST Levy | |

| Compensation Cess(CC) | |

| Compulsory Compliance Requirements (CCRs) | |

Breakdown of Your HSN Code

Cracking the HSN Code Structure

The HSN Code is like a well-organized catalogue. It’s made up of 21 sections, containing 99 chapters, 1,244 headings, and 5,224 subheadings.

Here’s how it’s structured:

• Each Section is divided into Chapters.

• Each Chapter is divided into Headings.

• Each Heading is divided into Sub Headings.

• Section and Chapter titles describe broad categories of goods

• Headings and Subheadings describe products in detail.

For Example:

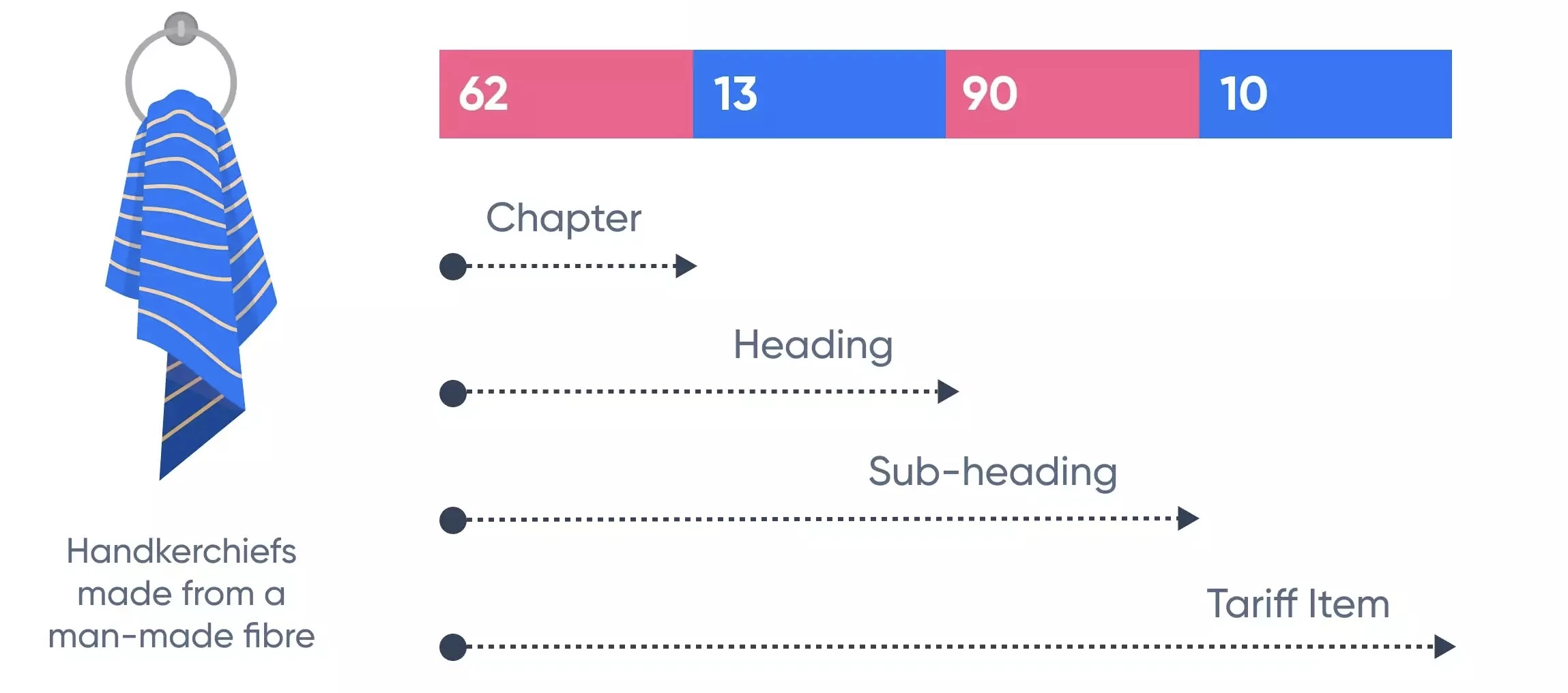

Consider towels made of textile materials with the HSN code 62.13.90.10

• First two digits (62) represent the chapter number for Articles of apparel and clothing accessories, not knitted or crocheted.

• Next two digits (13) represent the heading number for handkerchiefs.

• Finally, last two digits (90) is the product code for handkerchiefs made of other textile materials.

In India, we add 2 more digits for a deeper look. If the towels are made of man-made fibers, the HSN code becomes 62.13.90.10.

The HSN Code: What You Need to Know

The HSN code, short for “Harmonized System of Nomenclature,” is a simple way to classify goods globally. Imagine it as a 6-digit code that neatly categorizes over 5000 products and is recognized worldwide.

In 1988, the World Customs Organization (WCO) introduced this system to smoothen international trade. So, whenever you spot an HSN code, remember it’s there to streamline how products are sorted for global business.

How Does the HSN Code Actually Work?

Think of the HSN code as a super organized labelling system for goods. It’s like having around 5,000 groups of items, and each group gets a special six-digit code. This code helps keep things in order and makes sure everything is classified properly. This system follows clear rules to make sure everything is sorted uniformly.

Why Should You Care About HSN Codes?

HSN codes are like organized tags for stuff from all around the world. They help put things in order so that everyone knows what’s what. This makes sure things are sorted in a clear and neat way, making global trade work smoothly.

HSN Code Around the World

Imagine over 200 countries and economies coming together for a common system. This system helps everyone do a few things:

Sort things out the same way

Decide on Customs tariffs (that’s like taxes on stuff coming in or going out)

Keep track of trade between countries

Surprisingly, more than 98% of stuff traded between countries uses this system.

Almost all countries agree on the HSN code for each item. It’s like a secret code for each thing we trade. But in a few places, the code might be a bit different based on what the thing is.

HSN in India

India has been a proud member of the World Customs Organization (WCO) since 1971. At first, the country adopted 6-digit HSN codes to efficiently categorize items in Customs and Central Excise processes. However, to enhance accuracy, the authorities decided to fine-tune the system. They introduced an additional two digits to each code, resulting in an 8-digit classification. This meticulous approach allows us to pinpoint items with heightened precision.

Why is HS / HSN / HSN Codes important under GST?

The role of HSN codes is to ensure GST’s systematic implementation and global acceptance.

HSN codes eliminate the necessity of uploading detailed description of the goods. This streamlines the process, saving time and simplifying filing due to automated GST returns.

If a dealer or service provider falls within the specified turnover brackets,they must present a summary of sales categorized by HSN/SAC codes in their GSTR-1.

////////////////////////////////////////////////////////////////////////////////////////////////////

Frequently asked questions

What is the difference between an HSN code and a SAC code?

HSN codes are utilized for categorizing goods, while SAC codes find their application in classifying services.

What does HSN stand for?

HSN code stands for “Harmonized System of Nomenclature,” a universal system for categorizing goods across the globe.

What is ‘Aggregate Turnover’ in GST ?

‘Aggregate turnover’ in GST signifies the combined worth of all taxable supplies (except for inward supplies subject to reverse charge GST), exempt supplies, export supplies, and inter-state supplies by individuals sharing the same PAN. This computation applies nationwide and excludes CGST, SGST, UTGST, IGST, and cess.

Where Should HSN Codes Be Included?

HSN codes must be included on invoices or Bills of Supply, as well as in the GSTR-1 return.

Is HSN code 4 digit or 8 digit?

HSN Codes are typically 6 digit codes. However, in India, we have 8 digit HSN codes.

The initial two digits indicate the chapter number,

the next two digits represent the heading number,

the following two digits comprise the sub-heading,

and the last two digits are the tariff item.

What is 4 digit and 6 digit HSN code?

Four digit HSN codes comprise of the chapter number and heading only, whereas six digit HSN codes also comprise of the sub-heading of the product category.

What is HS and HSN code?

HSN Code is the same as the Harmonised System Code (HS Code) in shipping. However, it is more commonly known as the HSN in India. Like the HS Code list, each of the HSN codes for import and export of goods comprises six digits.

How to add HSN code in GST portal?

Step 1: Login to the GST portal.

Step 2: On Dashboard, Go to ‘Services’ > ‘Registration’ >‘Amndmnt of Rgistration Non-core fields’.

Step 3: Next, click on the ‘Goods and Services’ tab.

Step 4: Click on the ‘Goods’ tab.

Step 5: Search for the relevant HSN chapter by entering the HSN code or name of the item.

Step 6: Click ‘Save and continue’. Continue to click on the ‘Save’ button until the verification step.

Step 7: Complete the verification and submit via DSC or EVC.

Is HSN Code Compulsory on GST Invoices?

Indeed, in line with CGST notification 78/2020 dated 15th October 2020, HSN codes are mandatory on B2B invoices (4-digit codes) for taxpayers with an Annual Aggregate Turnover (AATO) of up to Rs.5 crore in the previous financial year. For B2C invoices, this inclusion is optional.

*Taxpayers with an AATO of more than Rs.5 crore in the previous financial year are required to declare HSN codes on all invoices (6-digit codes).

Is a GST Invoice Acceptable Without HSN Code?

No, a GST invoice will not be considered valid if it lacks an HSN code.

Are HSN codes the same/uniform across all countries?

HSN (Harmonized System of Nomenclature) was created by the World Customs Organization (WCO) to classify goods.

These codes are consistent among countries under the WCO.

Generally, 6-digit HSN codes are used. However, certain countries employ 8-digit codes for a more detailed classification of goods.

Do Taxpayers under Composition Scheme or Supplying Exempted Goods Need to Mention HSN Codes?

Yes, even taxpayers registered under the composition scheme or those supplying exempted goods must include HSN codes following the mentioned criteria.